by Don Gayhardt | Dec 22, 2020 | Budget, Finance, Investment, Loan, Money Management, Retirement, Savings

When planning for retirement, you need to consider the different types of accounts and be strategic about funding them. For many individuals, opening both traditional and Roth accounts helps save money by diversifying income in retirement, which can be critical for...

by Don Gayhardt | Dec 8, 2020 | Data, Finance, Investment, Money Management, Retirement, Savings

Retirement has become an especially stressful issue for the millions of Americans who are facing unemployment or reductions in their employee benefits. More than ever before, you will need to be strategic in how you save for retirement to make sure you can maximize...

by Don Gayhardt | Nov 10, 2020 | Data, Education, Finance, Information, Investment, Money Management, Retirement, Saving, Spending, Stocks

Few people can rely completely on Social Security to fund their retirement. However, it often serves as a central source of income. When retirement planning, you need to think strategically about your approach to Social Security. This means learning how the benefit is...

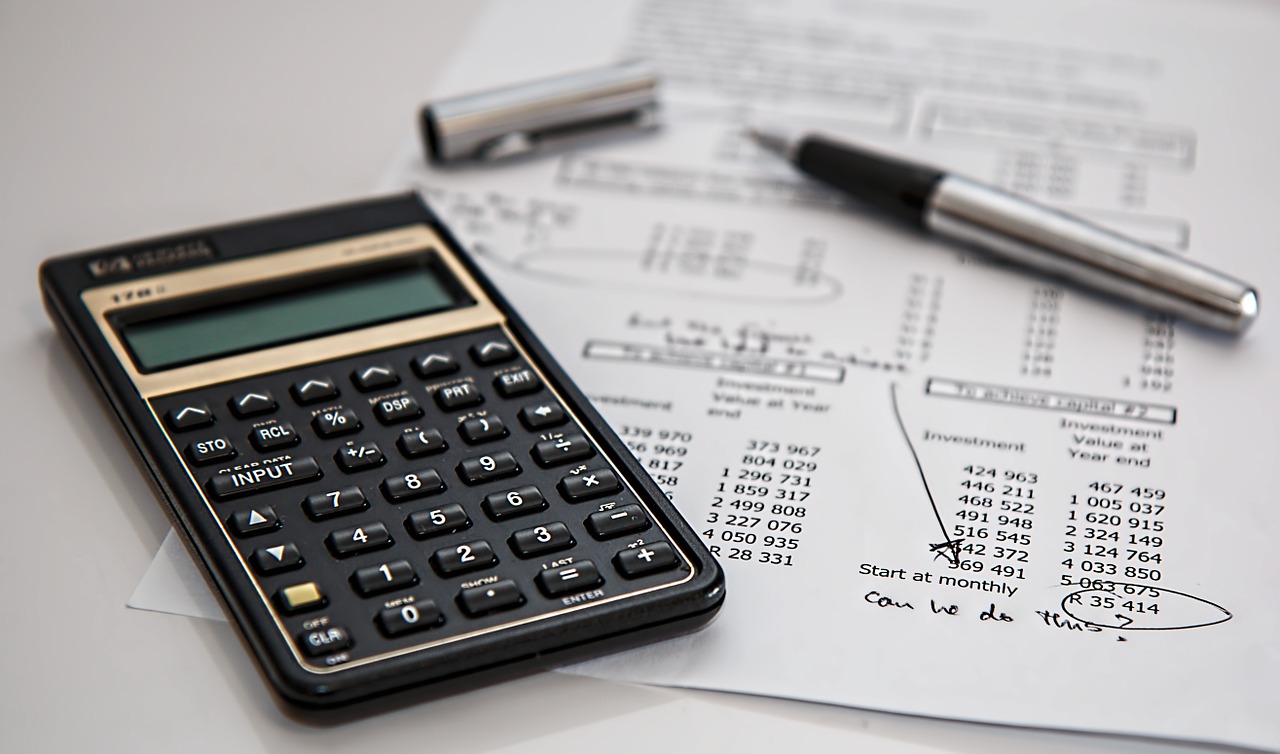

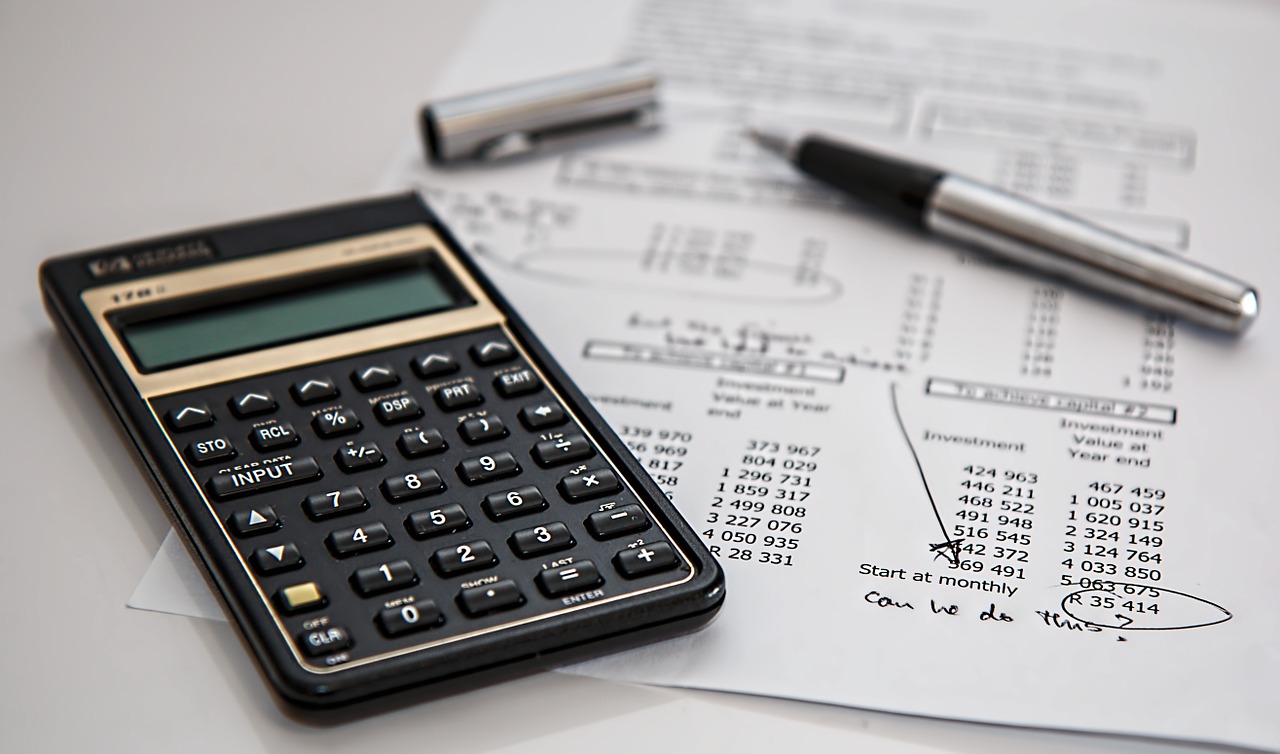

by Don Gayhardt | Jun 9, 2020 | Budget, Finance, Income, Money Management, Mortgage, Retirement, Saving

People may make a lot of mistakes when it comes to retirement planning, from not saving enough to making an unrealistic budget to guide savings. Planning for retirement involves a lot of guesswork as people estimate when and where they’ll retire. All too often, people...

by Don Gayhardt | May 22, 2020 | Data, Finance, Investment, Money Management, Retirement

In the age of social media, individuals often have many feeds that they track throughout the day, including those from LinkedIn, Twitter, Facebook, Instagram, Snapchat, and more. In the near future, individuals may be paying attention to a new sort of feed: the...

by Don Gayhardt | Jan 23, 2020 | Budget, Finance, Investment, Money Management, Retirement, Saving

Reading personal finance books is one of the best and easiest ways to take charge of your money and your future. But while some of the best personal finance books contain excellent advice, they are not always geared toward the beginner. Many individuals without much...